Deep DAO

The power of the crowd.

The power of the crowd.

You can buy DEEP tokens in the Fluid app with traditional currencies or digital cash.

You can buy DEEP tokens with DAI, USDC and USDT on Ethereum Mainnet.

An opportunity to participate in currency arbitrage profits usually only available to institutional investors.

DeepDAO’s smart algorithms capture daily currency price differences from a wide range of markets, and shares them with DAO members.

Consistent and exceptional returns, based on real-world cash flows.

DEEP tokens represent some of the most stable and high-quality collateral in DeFi. Fully composable with any protocol.

Trading pool opening on Uniswap soon. Capped issuance designed to enhance token value.

DAO Mission

DeepDAO seeks to deliver exceptional passive returns to token holders, driven by a dynamic currency arbitrage strategy.

How is this possible?

- Through a unique and seamless integration of the digital and traditional financial systems by our partner Fluid Finance, a Swiss-based company.

This integration creates efficiencies that lead to frequent arbitrage opportunities. - The total addressable market is enormous.

- The crowd working together adds depth to the strategy, allowing greater pricing potential and delivering higher returns.

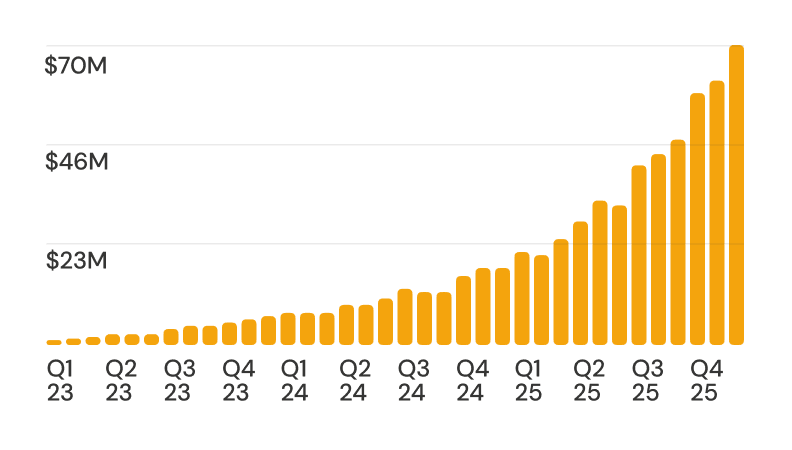

2—10% monthly

Based on compounding returns

(not simple returns)

Token holder returns after 3 years (monthly $millions)

How it works

Digital currency price > Traditional rates. DeepDAO buys traditional currency low and sells digital currency high.

Software algorithm. DeepDAO uses a software program that ranks price differences between currencies in the digital and traditional systems. The software then locks in the buy and sell at different prices and executes the trade. The program runs many different small operations as often as trades are profitable, when different markets are open, and is overseen by humans to reduce the chance of error.

Fluid enables anyone globally to connect a Web3 wallet to their traditional account or Fluid Account and drag and drop digital currency on-and-off-chain.

Compound returns

The DAO strategy delivers expected returns of 2-10% monthly.

These returns are paid to token holders in the following ways:

— in DUSD, on-chain or in the Fluid app

— in any of Fluid's currencies in the traditional world.

The deeper the pool, the greater the economies of scale.

These returns are then compounded for the benefit of DAO members. The longer your principle remains invested, the greater your ROI. This is because...

...DeepDAO members know that Einstein called compounding returns the ‘eighth wonder of the world’.

Collateral benefits

DeepDAO creates attractive collateral, backed by real-world cash flows. The tokens are designed to be composable throughout DeFi and provide attractive multi-use benefits to holders.

The delicious plug

and play DeFi protocol

DeFi liquidity

protocol

The global financial

super-app

DEEP will be accepted by Bakery Finance upon launch. Bakery Finance is a revolutionary new borrowing and lending protocol based on 1:1 collateral.

All DEEP token holders will be eligible for a snapshot-based airdrop of BKR tokens. See details at bakery.finance.

Explainer video

Currencies

Argentine Peso

ARS

Australian Dollar

AUD

Bahrain Dinar

BHD

British Pound

GBP

Bulgarian Lev

BGN

Canadian Dollar

CAD

Chinese Yuan

CNY

Czech Koruna

CZK

Danish Krone

DKK

Euro

EUR

Hong Kong Dollar

HKD

Hungarian Forint

HUF

Indian Rupee

INR

Indonesian Rupiah

IDR

Israeli Shekel

ILS

Japanese Yen

JPY

Kenyan Shilling

KES

Kuwait Dinar

KWD

Malaysian Ringgit

MYR

Mexican Peso

MXN

New Zealand Dollar

NZD

Norwegian Krone

NOK

Omani Rial

OMR

Philippine Peso

PHP

Polish Zloty

PLN

Qatar Rial

QAR

Romanian Leu

RON

Saudi Riyal

SAR

Singapore Dollar

SGD

South African Rand

ZAR

Swedish Krona

SEK

Swiss Franc

CHF

Thai Baht

THB

Turkish Lira

TRY

Ugandan Shilling

UGX

UAE Dirham

AED

US Dollar

USD

Governance & team

DeepDAO governance is very simple. The DAO a) leverages the collective power of a community of investors b) captures basic currency arbitrage using technology, and c) delivers returns to those investors.

There is no core team at DeepDAO (and no token allocation for any team members). All functionality is outsourced to Fluid Finance (infrastructure, basic operations) and is mainly executed by software. For this, Fluid takes an incentive reward of 30% of profits above a 10% profit hurdle rate.

DEEP token holders can vote on any aspect of the DAO in the future, including:

— New arbitrage strategies

— Involving other partners, besides Fluid

— Integrations with other protocols

— Payout mechanisms

Holding and staking DEEP tokens grants members voting rights in the protocol.

Staking DEEP tokens is what enables token holders to receive the protocol returns, which you will receive according to your staking weight (i.e. how many DEEP tokens you hold). There is a two week lock-up period from launch. After the initial two week lock-up, you can choose whether to make a claim on your returns, or let them generate further returns. Or, of course, you can choose to sell your tokens entirely.

Details of the staking mechanism will be live at launch.

DEEP token

| Contract address | 0x93F672915770A37d7Fd545845C9C04803e6A92a5 |

|---|---|

| Etherscan | |

| Type | ERC 20 token |

| Network | Ethereum |

| Exchange | Uniswap |

| Pool address | Available at launch |

| Max supply | 50,000,000 |

| Initial offer price | $1.00 per DEEP token |

| Payout | On-chain: via DUSD staking rewards. Via Fluid app: most global currencies, paid to traditional accounts or Fluid Accounts. Spend profits on Fluid Card. |

| Payout timing | Weekly |

| Use of funds | Up to 15% to admin costs, infrastructure, grants and community development. Min 85% to arbitrage operations and pool. |

| Note | As funds need to be put to work in arbitrage operations to generate returns, there will be a staking mechanism in place when the DAO launches. Returns will be paid out according to staking duration and staking weight. |

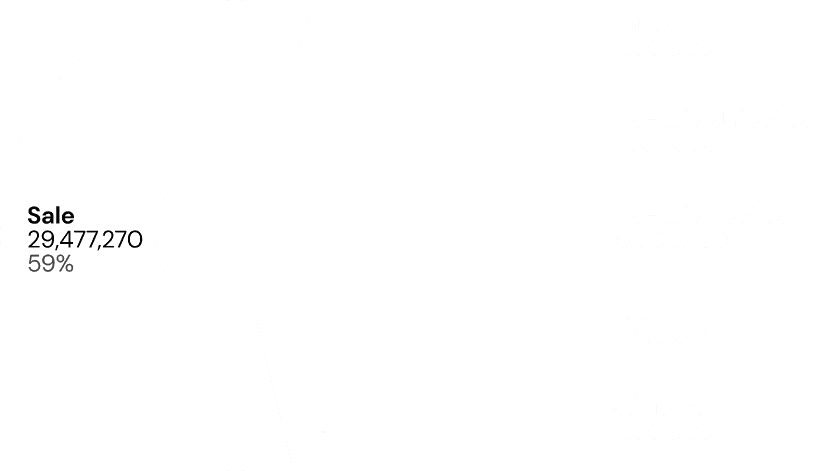

Token allocation

| Category | Lock periodMonths | Vesting periodMonths | Tokens allocation | Total of tokens | Unlocked at launch | Tokens at launch |

|---|---|---|---|---|---|---|

| Pre-saleUnlocked | 0 | 0 | 10% | 4,939,300 | 100% | 4,939,300 |

| Locked | 12 | 12*1 | 20% | 10,060,700 | 0% | 0 |

| Advisors | 1-6 | 0 | 3% | 1,590,909 | 0% | 0 |

| Token Sale | 0 | 0 | 59% | 29,477,270 | 100% | 29,477,270 |

| Bonus | 1 | 0 | 3% | 1,590,909 | 0% | 0 |

| Pool | 0 | 0 | 5%*2 | 2,340,912 | 100% | 2,340,912 |

| Total | 100% | 50,000,000 | 35,138,182 |

Subject to a vest period beginning Feb 1st 2024 and then unlocking incrementally at the start of each month over the next 12 months

5% liquidity pool of the total amount sold, not of the total supply

How to buy DEEP tokens

You can buy DEEP tokens in the Fluid app with traditional currencies or digital cash.

Tokens will be held custodially in the Fluid app.

You can buy DEEP tokens with DAI, USDC and USDT on Ethereum Mainnet.

Tokens will be allocated to your wallet address, and will be accessible upon Uniswap pool launch.

Public sale opening Mar 2, 2023

Public sale closing Apr 1, 2023

Sale allocation 44,477,270

Tokens sold 15,984,383

Tokens available 28,492,887

36% sold

Referral Bonus

If you have a referral code, collect your referral bonus:

In-app: enter referral code on the DEEP token tab.

On-chain: enter your code during the purchase process.

Fluid Bonus

If you hold a certain amount of FLUID tokens, you will receive bonus DEEP tokens on any in-app purchases when the public sale closes:

| Account tier | $FLUID Tokens HeldMin | $FLUID Tokens HeldMax | $DEEP Bonus |

|---|---|---|---|

| Basic | 0 | 0 | 0% |

| Fluid Fam | 1 | 999 | 0% |

| Bronze | 1,000 | 9,999 | 1% |

| Silver | 10,000 | 49,999 | 2% |

| Gold | 50,000 | 149,999 | 3% |

| Private banking (Whales) | 150,000 | >150,000 | 4% |

Bakery Airdrop

In addition, all DEEP token holders will be eligible for an airdrop of BKR tokens for Bakery Finance.

To claim the airdrop, just go to the claim website. Details to come soon.

Questions & Answers

Big Picture

What is DeepDAO’s thesis?

DeepDAO is based on a seamless integration of traditional finance and crypto networks. This allows the DAO’s software to run an attractive arbitrage strategy, capturing daily currency prices differences. These returns are then compounded for the benefit of DAO token holders. Digital currency is the future of money. The total addressable market is enormous.

The expected returns are 2-10% per month.

The DEEP token represents real-world cash flows, on-chain. It offers one of the highest yielding, and highest quality, returns in DeFi. And, one of the most solid collateral. Essentially it is tokenized TradFi, available in crypto for the first time.

Expected returns compound over time. The token supply is capped.

DeepDAO harnesses the power of the crowd to make the returns even bigger for everyone. The DAO’s mission is to eat Wall Street hedge funds and make DAO token holders rich.

How does Deep DAO generate profits?

- Deep is seamlessly integrated into the traditional and crypto systems. With Deep, currency can be dragged and dropped on- and off-chain in seconds.

- The TradFi-crypto integration allows Deep to capture currency price differences not usually available elsewhere. This is a result of cutting out middlemen (like banking and payment systems), delivering digital currency, and use of p2p networks.

- Currency returns are compounded, for the benefit of token holders.

What TradFi systems is DeepDAO integrated into?

DeepDAO has access to most banking systems around the world, including Swift, SEPA, UK Faster Payments, Fedwire, ACH, AusPayNet, FPS (HK), SKN (Indonesia), IBG (Malaysia), EFT (Canada), RIX (Sweden), NICS (Norway), IMPS (India) and others.

Deep DAO (via Fluid) also runs on Arbitrum and will expand to Ethereum Mainnet shortly.

What chains is DeepDAO integrated into?

Ethereum Mainnet and Arbitrum*.

*Via the operating partnership with Fluid. DUSD - DAI pools are built on Balancer.

What does DeepDAO do that others don’t?

DeepDAO uses digital and traditional networks to capture currency price differences for token holders. Almost no one is integrated into these networks like DeepDAO and no one else applies this strategy.

What is the market size?

The currency markets are large. Foreign exchange volume was approximately $7.5 trillion per day in 2022 on a net-net basis*.

*Bank for International Settlements, 2022 Triennial Survey of turnover in OTC FX markets.

How does DeepDAO work with Fluid?

DeepDAO uses some of Fluid’s integrations for buying and selling currencies. Fluid is a financial super-app based in Switzerland that enables currencies to be dragged and dropped on- and off-chain from a bank account. DeepDAO can replace Fluid or add other partners. Fluid cannot provide competing services to any other entity or end the relationship with the DAO (only the DAO can end it).

What other operations might DeepDAO undertake in the future?

DeepDAO token holders can decide on any future strategy, similar to an investment club. For example, DeepDAO might decide to organise investments in tech stocks, indexes, commodities, etc. These would probably be separate from, and additional to, the existing currency strategy.

How can I get bonuses?

You can use a referral code, if you have one.

Wait, do I need a referral code?

No. Anyone can purchase tokens on the DeepDAO website without a referral code.

But if I have a referral code, how do I use it?

It’s straightforward - either enter it into the purchase screen in the Fluid app, or you can buy DEEP with a Web3 wallet, click "Add referral code", then enter your referral code.

What can I do with DEEP tokens, besides get upside benefits?

DEEP tokens are designed to be composable throughout DeFi. You can also use them for borrowing on Bakery Finance (launching soon).

Will there be an airdrop?

Yes, DEEP token holders will get a future airdrop of BKR tokens, from Bakery Finance.

Are DeepDAO’s operations audited?

Yes. Chartwell & Partners in Switzerland controls the operations on a monthly basis. There are no asset investments (like commercial paper, treasuries, etc) that have variable valuations, just simple currency. Currency is as reported by the partner banks (e.g. via Currencycloud). Financial statements will be audited quarterly by SIGTAX in Switzerland.

DAO Functionality

How does DeepDAO generate yield for these tokens?

It is actually profit-sharing from currency arbitrage, rather than yield. DeepDAO is integrated into the traditional financial system and also crypto, so we are able to take advantage of the difference between the official rate and the market rate in many countries.

DeepDAO sources currencies at wholesale market rates and (at times) uses digital rails and peer to peer markets to offer a much better rate to the user and captures an attractive spread for the DAO. DeepDAO also matches different currency flows, cutting out the payment system middleman. By reducing the (often grossly inflated) cost of sending money globally, we contribute to our mission of building a better financial model for a better world and also generating attractive returns for our users. And, like everything we do, it is open for everyone, not just the 1%.

What are the risks of investing in a DAO like this?

All investments have risk and you should never invest more than you are prepared to lose.

DeepDAO’s strategy is designed to be lower risk. Besides some fixed costs, the DAO deploys funds to earn some of the difference between different currency rates, meaning the risk parameters are fairly limited.

Does the arbitrage mechanism follow USD>ETH>Local Currency>USD or another route?

It is more like USD > mint DUSD > DAI > Local currency through local partners or Fluid’s P2P market.

There are also other routes, involving purely fiat currencies. Fluid accesses FX at wholesale rates usually only available to the largest banks, giving it a price advantage.

There is also the pure crypto route: arbitraging our DAI – DUSD pool on Balancer. Often this provides returns of >1% daily.

How does compounding work?

DeepDAO compounds returns on a daily basis.

Here are two guys who know a lot about compound interest;

"Compound interest is the eighth wonder of the world. He who understands it, earns it…he who doesn't… pays it"- Albert Einstein

"My wealth has come from a combination of living in America, some lucky genes, and compound interest"- Warren Buffett

The effect of capturing daily currency price differences is used by DeepDAO to compound returns for the benefit of token holders. This can be seen from DeepDAO models, below.

Governance

What is the governance philosophy?

Minimalistic. DeepDAO token holders are in charge, but it is intended that the investment thesis is treated a bit like a constitution and not to be changed unless necessary.

Many DAOs have low governance participation rates. DeepDAO is intended for token holders to actively accept the DAO’s strategy, but then the strategy should just execute. There is no core team, no overhead expenses, just a partnership with Fluid for operations.

In principle, DeepDAO token holders can change anything. Fluid can be replaced and additional partners can be added. The DAO can also adopt other strategies.

What is the management fee?

The fee to Fluid is set at 2.5% of TVL (AUM) per year to maintain operations.

What is the incentive fee?

The incentive fee to Fluid is set at 30% of profits per year. The incentive fee is payable after the DAO has earned 10% on an annual basis. This means that Fluid will be paid 30% of the profits above a 10% threshold rate for facilitating the success of the DAO.

For example, if DAO earns 25%, then the 15% above the threshold rate will be shared between the DAO (70%) and Fluid (30%). In this case, Fluid would get 30% of 15%, equal to 4.5%. The DAO would get 10% + 10.5%, equal to 20.5%.

Does Fluid provide advice or management to the DAO?

No. The DAO just uses Fluid’s infrastructure and Fluid carries out the DAO’s strategy.

Can Fluid be replaced by the DAO?

Yes.

Can other partners be added by the DAO?

Yes.

Can Fluid stop providing services to the DAO?

No.

Will there be a governance forum?

Yes, a governance forum is planned. DeepDAO is a bit like an investment club and the forum is intended to be a place to discuss executable ideas.

Are there any planned governance votes already?

No, because the DAO is just starting. There is a proposal and voting mechanism being developed.

Is DAO membership considered active or passive?

Membership in DeepDAO is an active function. You are not making a profit from the actions of others. You, yourself, decide on the actions of the DAO.

That being said, after the initial decision to group funds to exchange currencies as principals, there isn’t much to do. The decision is then just put into action.

Are there any planned real-world meet-ups?

Some members have suggested meet-ups where Wall Street types are fed to pools of piranha in a James Bond-style movie scene, but this has not yet been approved by lawyers.

Is the DAO incorporated anywhere?

No. There have been some suggestions to incorporate the DAO as a foundation in Switzerland. DeepDAO token holders can decide on this in the future.

DEEP Tokens

Can anyone buy these tokens?

Yes*.

*Unless you are on a naughty list from the Swiss government. DeepDAO also does not accept users from all countries set out in Annex 5 of the Fluid app. See fluid.ch for terms.

How do you buy DEEP tokens?

You can buy DEEP tokens directly through the DeepDAO website with crypto, or through the Fluid app. DEEP will also be available on Uniswap.

What is the price of the DEEP token?

DEEP tokens may be purchased by initial participants at $1 per token. The DAO intends to create a pool for these tokens on Uniswap after the public sale. At this time, the price of the DEEP token will vary according to demand between buyers and sellers.

Where will the pool be established?

DeepDAO intends to establish a pool on Uniswap, on Ethereum Mainnet. The pool that is planned is DUSD - DEEP.

DUSD is Fluid’s digital currency, which is essentially real money, on-chain. You can connect your Web3 wallet to an account and drag and drop DUSD on and off chain. DUSD can also be easily converted to DAI and used throughout crypto.

How does DUSD interact with DAI? How does it compare to other stablecoins?

Details of Fluid’s DUSD digital cash are set out below.

What tokens can I use to buy DEEP tokens during the initial fundraise?

You can buy DEEP tokens with DAI, USDC and USDT.

The tokens are valued in (digital) US dollars, right?

Correct.

Are these tokens a security?

No.

DeepDAO is owned by token holders and acts as a principal in simple currency exchanges. The DAO coordinates token holder funds, executes an agreed strategy based on software, and delivers the exchanged currency to token holders. The DAO does not act as a foreign exchange broker, nor undertake futures or other regulated transactions.

Will the DAO returns be distributed in digital dollars (DUSD), on-chain?

Yes.

DeepDAO uses Fluid’s digital cash (and traditional currencies). These are available in 32 different currencies. On-chain, DeepDAO uses Fluid’s digital dollars (DUSD), which is exchangeable with other crypto.

There is also the option to receive returns in all of the traditional or digital currencies offered through the Fluid App. DAO token holders can also spend the currency returns on Fluid Cards*.

*Fluid Cards are available to (almost) everyone globally. See fluid.ch for more details.

How often and when will the returns be paid out?

Returns will be paid weekly. Note, you must stake your tokens to be eligible for the profit-share.

How do I claim returns?

There will be a claims section on the DeepDAO website. Having a claims procedure allows token holders to have control. Token holders can decide when they want to take their profits, since this may have tax implications in some countries.

How much of the returns will go to the token holders?

All of it, minus the fees to Fluid.

The predicted APY of 2-10% per month is based on past returns. Do you think this can continue in the future? What is the risk of corrections in crypto?

The returns for the DAO are not related to crypto at all. It is just that it is tokenized. The returns will come mainly from the difference between the official and the market rates for over 30 different countries that we are targeting.

A small portion does come from arbitraging the DAI – DUSD pool on Balancer. The profitability of the DAO is more related to currency differentials than crypto market sentiment.

What happens to unsold tokens?

They will be burned.

Was there a pre-sale?

Yes, 15 million tokens were sold in a pre-sale (bonus included). These tokens have then been locked for the past several months. There was an uplift given to these early investors, of approximately 2x the purchase price.

Of these tokens, approximately 78% are subject to a vesting period that starts on 1 February 2024 and then unlocks equally at the start of each month over the next 12 months. During this time, token holders benefit from returns and can vote, but may not sell their tokens into the pool.

Informally, many of these pre-sale investors have said that they intend to hold the tokens for future currency returns and/or to convert the tokens into NFTs and stake them on Bakery Finance.

Are the tokens a membership fee in the DAO?

Officially, anyone can be a “member” of the DAO*. There is no membership fee. A big part of the DAO’s work is educational and we encourage everyone to understand more about how currency works, the benefits of compound interest, etc.

However, only those who purchase tokens are acting as principals and pooling their resources to exchange currencies. We usually refer to these people as members.

*Since the DAO is open and permissionless, the concept of member doesn’t apply. The term member is used only for convenience.

When/how can I sell my tokens?

After the initial fundraise, you will be able to sell them on Uniswap. There is a two week lock-up from launch.

Incentives (bonuses)

How can I get bonuses?

You can use a referral code, if you have one.

How does the referral code work?

If you have a referral code, you can enter it when you purchase DEEP tokens. You will be prompted for a referral code at the time of purchase.

Everyone with a referral code is eligible for a 5% bonus of DEEP tokens.

If I buy DEEP tokens, will I get an airdrop for Bakery Finance?

Yes.

Composability

Can I use my DEEP tokens as collateral on Bakery?

Yes you can, staked DEEP tokens can be used as collateral on Bakery Finance. This can be done through an NFT mechanism representing the value of staked tokens.

Can DEEP tokens be used throughout DeFi?

Yes, that is the idea. DEEP tokens represent high-quality, real-world cash flows, tied to RWAs (Real-World Assets). They are designed to be amongst the best collateral in DeFi.

Can I use DEEP tokens for borrowing?

Yes.

You can also use them for borrowing on Bakery Finance (launching soon).

Other protocols may integrate DEEP tokens (or their NFTs) as well, permissionlessly.

Can other protocols build on DeepDAO or Fluid?

Yes.

DeepDAO and Fluid both intend to allow other protocols to use the infrastructure that has been built to integrate traditional finance and crypto. This is in development.

Our vision is mass adoption of crypto. And high returns for DEEP token holders.

Bakery Finance

What is Bakery Finance?

Bakery is a 1:1 borrowing-lending protocol focused on real-world assets. And a lot more. You can check it out here.

How can I use the DEEP token on Bakery?

You will be able to use our DEEP token as collateral on Bakery, as your DEEP token has a price floor (1 DEEP == x$ in the fund) you will be able to get up to 1:1 lending rate.

How do the NFTs work?

The DEEP token will be turned into an NFT representing your position in the arbitrage bot. No price fluctuations based on the DeFi Market, the NFT position is tied to the RWA in DeepDAO. You will be able to unlock the power of the arbitrage position while increasing your DeFi assets at a very low rate.

Can you give an example of how I can profit from my DEEP tokens on Bakery?

Deposit your DEEP as a collateral in Bakery, earn your nice APY, Borrow at a low rate DUSD against your DEEP with a price fluctuation protection, invest back your borrowing within DEEP or any DeFI product.

Example :

- DEEP earning : 40%

- Borrowing interest rate : 5%

- DUSD re-investment APY : 40%

Total earning: 75%, while the loan auto-repays.

Will my purchase of DEEP tokens make me eligible for an airdrop of the BKR tokens that is coming up?

Yes. You can follow Bakery socials for details.